Just a few things of interest this month that impact my finances and work, and decent form by Norwich City at the top of the Championship, make it a month that I am reasonably happy with.

As all my money has a purpose each month, I utilised my Emergency Fund (EF) to cover the cost of two new tyres for my car. The reason for using the EF is that I keep next to no money in my current account, pretty much just what I need for groceries and petrol.

The company I bought the tyres from are based in Andorra so to protect myself I paid for them using a credit card and then immediately paid the balance off with the EF money. There were some indifferent reviews on the web but I have no complaints at all, the order process went fine and the tyres arrived three days later.

With work, I received my variation of contract making me a permanent home worker. Some of my office-based colleagues may say about costs increasing by WFH but the heating is still going to be on at the same times as my kids and wife are home at different points during the day. Electricity will increase slightly and the broadband bill will remain the same.

My company will be paying me £26 expenses per month directly to help offset WFH expenses, this is pretty handy as it means I will not have to make a claim to the Inland Revenue myself.

Additional Income Streams

- Matched Betting £51 (Nov £137)

- Surveys/studies £5.72 (Nov £10.21)

- eBay £37

- TopCashBack £13.06

The eBay income came from the sale of our old TV which had a broken screen (teenager + game console!). The guy who bought the TV wanted it to repair his broken unit so I felt happy with this sale as it helped prevent two TVs going to landfill. The proceeds went to help pay down my credit card bill 🙂

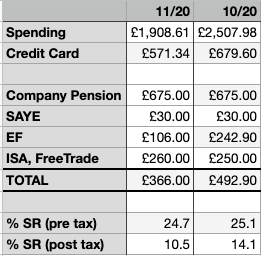

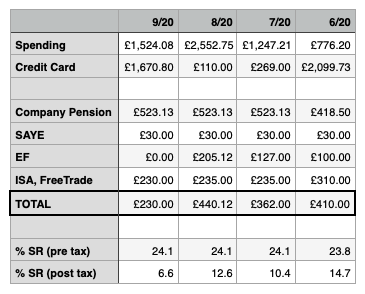

How did I do in December?

Assets

- Emergency Fund £1,500 (£1,150.80)

- ISA, Freetrade £3,611.82 (£3,546.79)

- ISA, Hargreaves Lansdown £2,713.38 (£2,682.73)

- Pensions £98,995.33 (£97,194.47)

- SAYE £420.00 (£390.00)

- House £350,883 (£350,883) *HPI current valuation

Liabilities

- Credit Card -£950.99 (-£1,728.26)

- Student Loan -£3,656.77 (-£3,806.77)

- Mortgage -£190,092.68 (-£189,487.04)

Total Assets (excluding house) – Total Liabilities = Net Worth

£107,240.53 – £194,700.44 = -£87,459.91 (-£90,057.28)

Not so much added to my FreeTrade ISA this month as I bulked up my emergency fund and paid a bit more than usual off my credit card.

My plan to clear the credit card debt in January might be pushed back to February now although it depends on additional repayments I can sneak in next month.

The pension contribution reflects an additional one per cent, that coupled with a new Vanguard SIPP I opened for Mrs Frugalist means that we are now putting 15% of our household income into pensions. That’s another personal milestone met 🙂

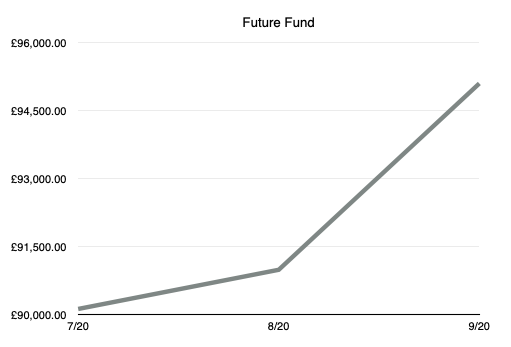

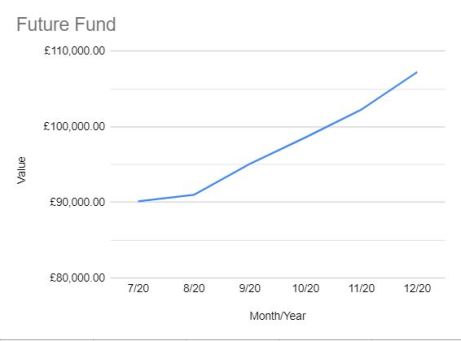

Future Fund

It’s nice to see the graph continuing to move up & right, this month’s gain puts me quite near the £110,000 mark and is a good way to end the year. Just over half of the gain is from the inclusion of my Hargreaves Lansdown ISA which was missing from last month’s FF.

Dividends

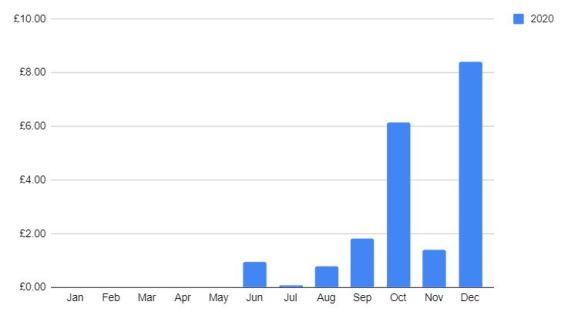

A late flurry of dividends this month gave me a nice fuzzy feeling as payments crept past the £8 mark for the month.

It’s nice to look ahead to the prospect of seeing how 2021 payments compare to 2020. Who knows what they will look like as amongst many things the economy will continue to be influenced by COVID-19 and also the departure from the EU.

Looking ahead to 2021

I’ll share my review of 2020 shortly and also my plans for 2021. I’m going to try and concentrate on the processes required to meet my goals rather than just the goals themselves, I think this level of planning will help with my motivation.

Guest Post

This month I had the opportunity to share a post from Martin at Studenomics, he shares his thoughts on what to look for in your first side hustle – things to watch out for and how to choose the right one.

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!

Vanity Metrics

These are metrics which serve me no purpose other than to see progress, or lack of, in the social media universe.

Alexa ranking: #1,298,570

Twitter followers: 295

Blog followers: 29