January was a really quiet month in most aspects of my life. It started off with the back-to-work blues, then my wife caught COVID-19 from work and a week later I caught it too. The worst part of it for me was the tiredness which lasted two to three weeks. During that time I didn’t really feel like doing much so things like matched betting took a backseat (which you’ll see further down the post).

What could have been a large outgoing this month turned out to be not so bad. My car was due it’s annual service and MOT at the end of January but instead of paying the £450 for the service by Volvo, I used Spencers, an independent garage in a nearby village, and paid just £145 for both the service and MOT.

One of the good things about becoming more financially aware is that I budget each month for expenditure such as the above so there wasn’t a moment of panic or a compulsion to reach for the credit card!

Additional Income Streams

- Matched Betting £30 (Dec £51)

- Surveys/studies £5.82 (Dec £5.72)

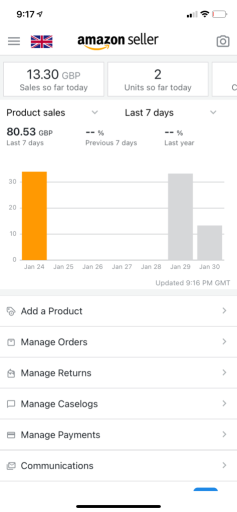

- Amazon FBA £37

- TopCashBack £8.81 (Dec £13.06)

I use a service called Odds Monkey to help with my matched betting, I’ve been using them for several months now and find the tools they provide to be essential in making a profit. If you are interested then drop me a message or you can sign-up via my affiliate link – OddsMonkey. The great things is you can do as much or as little as you like and it fits around your life.

My FBA profits came from two different items that I sent in having purchased them before Christmas. There were multiple units of each item, one of which has now sold out and the other is close to selling out too. I’m not going to disclose what the items are as they seem to be good sellers and I’m on the look on for further deals on them.

One item provided me with a 39% profit on a sales value of £16.96, and the other gave me 47% on £6.65. That’s not bad after the UPS fee and the FBA fees have been paid.

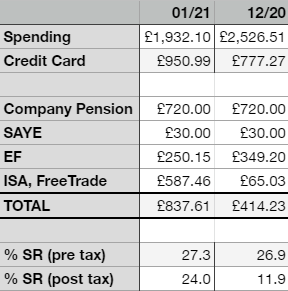

How did I do in January?

Assets

- Emergency Fund £1,750 (Dec £1,500.00)

- ISA, Freetrade £2,899.28 (Dec £3,611.82)

- ISA, Hargreaves Lansdown £2,849.54 (Dec £2,713.38)

- Pensions £100,040.25 (Dec £98,995.33)

- SAYE £420.00 (Dec £420.00)

- House £360,099 (£350,883) *Nationwide HPI 2020 Q4

Liabilities

- Credit Card £0 (Dec -£950.99)

- Student Loan -£3,516.77 (Dec -£3,656.77)

- Mortgage -£190,422.22 (Dec -£190,092.68)

Total Assets (excluding house) – Total Liabilities = Net Worth

£107,959.07 – £193,938.99 = -£85,979.92 (Dec -£87,459.9)

There was an adjustment to the value of my Freetrade ISA as I reallocated some funds.

I added £200 of NS&I premium bonds to my Emergency Fund this month, the rest of the month’s contributions remains in cash.

The good news is that I managed to clear the balance on my final credit card this month which frees me up to pay extra into my EF or pay down my student loan. It’s a great feeling to know I no longer have any debts owed to credit card companies 🙂

Almost forget to include Mrs Frugalist’s SIPP in the calculations as this is the first-month showing payment. I’ll have to look into her Nest pension organised by her company and get that added in next month.

Future Fund

Still moving in the right direction but gains on the smaller side this month.

Dividends

A lack of dividends paid this month looks naff but a payment for February sneaked its way into the screenshot!

Guest Post

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!

Vanity Metrics

These are metrics which serve me no purpose other than to see progress, or lack of, in the social media universe.

I can’t compare January to December using Modest Money as my blog appears to not be listed but these stats come from Alexa, Twitter and WordPress instead.

Alexa ranking: #4,267,238 (Dec #1,298,570)

Twitter followers: 382 (Dec 295)

Blog followers: 44 (Dec 29