October was a pretty decent month for me; personally, professionally, and financially.

In work, I got my promotion (finally) confirmed and a nice, chunky pay rise which was due to the promotion but also bringing me more toward market value.

Like most people, I already had plans for what I’d do with my extra pay but being on my journey to FI I didn’t pre-order a whacking great big TV or sign-up to lease a new car, instead I put a plan in place to use the money to pay down my debt faster.

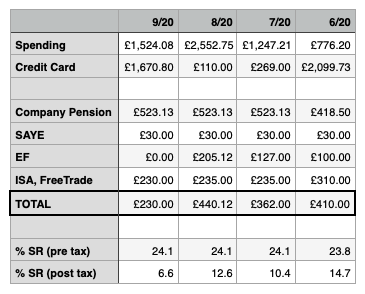

I should now be able to clear my credit card debt within five months which will be awesome. Will be the first time in as long as I can remember that I’d not owe money on a card. Also, this month I’ve been making additional payments to my card which is shown in the table below.

Once the card is paid off, I’ll shift my attention to my student loan, thankfully it is small (around £4k) but it will still take a little while to pay off. Probably around this time next year it should be dealt with which will leave me with the extra money plus £140/month more which is currently deducted automatically from my salary.

Toward the start of the month, I decided to get rid of my loan I took out when I purchased my new phone. The balance was £434 and has resulted in a monthly saving of £29, or just under £350 a year 🙂

Matched Betting

I thought October was going to be a struggle in terms of making much profit but it turned out to be pretty decent by my terms.

The profit in the first two weeks alone passed that for the whole of September, a fair proportion of that was from taking the boosted odds from the likes of Ladbrokes and William Hill each day. A lot of small gains added up nicely.

For the first time, I withdrew some profits from my matched betting ecosystem, this was used to reduce my credit card balance. I’ll need to take some more funds from my exchange accounts and redistribute it across some of the bookies as a lot of the funds have flowed the other way.

Also tried a few accumulators, mainly as a learning exercise, but I think out of about five or so only one returned a small profit. As fellow matched better, weenie warned me, it’s hard at the moment to make anything from an acca as the football results are all over the place.

It’s great that football has returned and individual fixtures can still throw profits, especially when you get free/risk-free bets, but trying to string together results in an acca is a totally different proposition.

Holiday – yay!

Having had pretty much no real break from work this year, I attended an annual golf weekend on the North Norfolk coast. This I think is the fourth year running that we have stayed and played at Heacham Manor although I had to cancel last minute in 2019.

It was nice to get away and spend some time with friends some of whom I have not seen for a couple of years.

We always start off with a coffee and bacon roll in the clubhouse before getting in a round and unlike 2018, the weather wasn’t too bad. Despite being windy and wet for the first three holes, it eased up and toward the end, it was actually warm enough to take off my water proof jacket!

The evenings are always fun too. I shared a cottage apartment with one of my best mates and spent a good while chatting and drinking G&Ts before heading to the restaurant for the three course meal. We had to split into two groups due to social restrictions but that was fine.

I didn’t play any golf in the morning before coming home although some of the guys did stop around for that.

We also had a long-awaited family holiday to a cottage in a village outside Nottingham. Having originally booked for the four of us plus Skyla, my son had his shifts come through for his new job which meant he wasn’t able to come 🙁

I had looked to see if we could postpone this break as there was talk of Nottingham going into tier 3 but nothing confirmed so the booking company wouldn’t have been able to help. I’m glad we went though, the cottage was lovely – small but really cosy, and it was nice to have a change of scenery.

It rained on and off each day but we still got out for walks with Skyla and had a few pub lunches/dinners. Was good to spend some time with Freya away from home, she managed to tear herself away from her phone a few times and join in the conversations.

We ended up leaving a couple of days earlier than planned as the whole county was due to be locked down and placed into tier three, that, plus the rain and a slightly moany teenager kind of told us it was time to come home!

Additional Income Streams

- Matched Betting £275 profit (Sept £158)

- Surveys/studies £16.56 (Sept £17.99)

Up to the end of October, I have made just over £53 from Prolific surveys, not game-changing but it all counts and it’s the time when I’m not particularly active and just unwinding.

Still not been able to pass any pre-qualifying checks for UserTesting, might continue trying with this for a while longer and see how it goes.

Well pleased with matched betting profit for last month. Between the surveys and matched betting profit in October, I was able to pay off an extra £300.

How did I do in October?

Notably, this month were expenses coming in at just under £900 on the holiday in Nottinghamshire, this covered the balance of the rental cottage, groceries, eating out and some clothes shopping for my daughter 🙂

It’s nice to see my pension contributions increase this month, my percentage rate has remained the same just that I’m now getting paid a bit more 🙂

Slightly increased amount added to my ISA this month, I think this will remain pretty static until I get some debts cleared.

It’s frustrating having to divert money from savings/investments to pay off debt but I don’t want to beat myself up about it as my life is different since finding FIRE.

My combined saving rate of 39.2% is pleasing, it’s encouraging me to keep working at the three pillars – cutting expenses, earning more, and saving more.

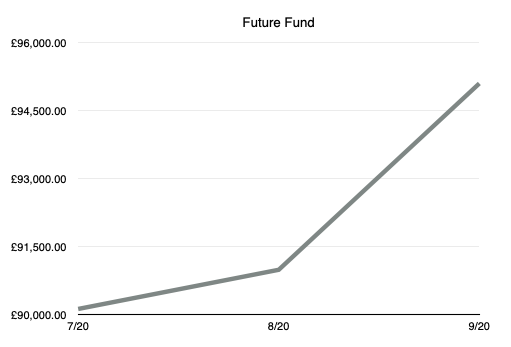

Future Fund

Another good month for my pension as that has gone up £3,500 since September. Not sure what it will look like at the end of November though as the US Presidential election would have taken place which may impact the market. Still, that’s not in my sphere of influence so I’m not going to worry about it.

I’m starting to think as to whether an end-of-year review is something worth doing, summing up any highlights as well as my progress to better financial health.

Is this something that you do/have done in the past? Do you find it useful? Would love to hear your thoughts in the comments section below.