Quiet month for me in general so I’ll crack on with things…

Additional Income Streams

- Matched Betting £137 (Oct £275)

- Surveys/studies £10.21 (Oct £16.56)

Things were a bit slower this month with my matched betting although I still made a >£100 profit which I’m fine with. I wasn’t feeling it for a good while so just dipped in and out as I fancied it.

How did I do in November?

Assets

- Emergency Fund £1,150.80 (£1,107.69)

- ISA, Freetrade £3,546.79 (£2,187.76)

- ISA, Hargreaves Lansdown £2,682.73 (not recorded)

- Pensions £97,194.47 (£94,943.49)

- SAYE £390.00 (£360.00)

- House £350,883 (not recorded) *HPI current valuation

Liabilities

- Credit Card -£1,728.26 (-£2,299.60)

- Student Loan -£3,806.77 (-£3,960.77)

- Mortgage -£189,487.04 (-£190,668.62)

Total Assets (excluding house) – Total Liabilities = Net Worth

£104,964.79 – £195,022.07 = -£90,057.28

Yes, I have a big mortgage and the repayments are pretty hefty but the decisions around that were made pre-FIRE journey.

We could downsize as we have a spare bedroom and an office/5th bedroom but when we looked into this a few years ago there just wasn’t much to gain if we want to stay in the current area. We’re not looking to relocate just yet as my daughter is in her final year at high school and then hopefully starting college. Renting out the spare room could be an option we considering though…

It’s not something I’d rule out in the future as I like the idea of geo-arbitrage although that comes with other considerations such as having the best dog in the world that we would have to take with us as I’d not even think about giving her up.

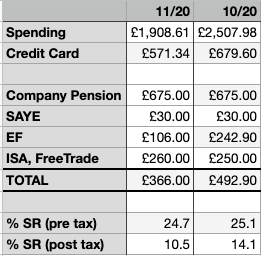

As you can see, although my spending and credit card payments are down this month, my savings rates are down too. Part of the reason for this is a bit of lethargy, I just struggled with motivation to bring in extra money which would have been used to reduce debt and increase savings.

Thankfully, my credit card payments should be done with ahead of schedule – it’s now looking like the bulk of the balance should be cleared in December and then January will mop up the remaining balance.

Whether then to start on paying down my Student Loan or to add to my Emergency Fund is the question. My Student Loan is under £4,000 and attracts a rate of interest of 2.6%.

I’d be interested in hearing your thoughts on this – would you clear the loan and be rid of all debt (except mortgage) or build your EF a bit more?

Future Fund

Continued good performance from my Scottish Widows pension scheme and a boost to the Freetrade ISA saw me edge past the £100,000 milestone.

So happy about this as it is the first big milestone that I have hit on my way to FIRE 🙂

Also, just while compiling my list of assets and liabilities/debts (above), I realised that I have not included my HL ISA in my Future Fund so that’ll be added from December onward.

I have set the next milestone at £150k which I plan to make in the next couple of years. Increased pension contributions, both from higher saving rate & higher salary, plus side hustles and general market performance although the latter cannot be relied upon.

Started recording my dividend payments in my Freetrade ISA (lazy portfolio) which can be seen in the graph below. I’ll provide a breakdown of my lazy portfolio in the future showing what funds I have.

Not likely to be retiring any time soon on the above level of payments but I expect these numbers to grow nicely over time. I’ve set an informal target of the monthly dividends being enough to cover my mobile phone payment which is not much, like £5, so should hopefully be achievable in the next 12 months. I’ll then add the next notional target – over time the goal is to have the dividends covering a significant proportion of my regular expenses.

Credits

I have taken inspiration and assistance from a couple of other FIRE bloggers in the creation of my monthly updates so I’d like to take the opportunity now to say thank you.

Weenie over at QuietlySaving – thanks for providing quality posts, yours was the first FIRE blog I started reading and it was from your updates that I “borrowed” the Future Fund concept. Also a big thank you for your help with my dividend graphing (see above) – I was banging my head against the wall with Apple Numbers trying to get it right, I then went from Excel (thanks!) to Google Sheets and I’m pretty happy with the result.

You can read what Weenie’s November looked like here.

Sassenach Saving‘s monthly updates provided me with the thought of breaking down my assets and debts for a month-on-month comparison. Check out their November update here.

Thanks for the mention. Your figures are looking good. In terms of your emergency fund vs student loan, if it was me I’d probably be tempted to get my EF a bit higher before I tackled the student loan. Each to their own though. As long as you’re not frittering your money away then probably either would be good.

Yeah, I’m pulled between clearing “consumer” debt and building my EF. One of my milestones is to get a months worth of expenses covered.

I can do that once I have cleared my CC – that’ll be a major win for me.

Defo not frittering away my money – maybe in my pre-FIRE life I would have done but now, I carefully consider ever purchase.

Thanks for the feedback 😁

Congrats on the £100k milestone – love the badge! The first £100k is apparently the hardest so your second one should come round much faster!

Cheers for the shout out – just happy to help 🙂

Like SS, I’d be tempted to get the EF a bit higher too first, to provide a buffer so your good work doesn’t get unravelled in the event of some emergency.

Anyway, hope you have a great December, happy Christmas and all that and best of luck in the MB!

A great start to your dividend payments graph – it all starts getting interesting next year, when you start seeing how they increase!

Thanks Weenie, appreciate that! 😁

I’ve taken onboard what you and SS have suggested and I’ve put some extra funds toward my EF already. Hope to add a bit more further in the month depending on my MB 👍

Thanks, merry Christmas to you too 🎄