I thought it might be interesting to share the structure of my main portfolio – this is where I have calculated the percentage break-downs for different markets based on my level of comfort.

There are several rules of thumb for determining the split between equities and bonds such as subtracting your age from 100 to give you the bonds (your age) and equities (the remainder) split.

As I didn’t get started with FIRE until “late on” i.e. my forties, I have gone for a more aggressive split of 20% bonds/80% equities.

At the broadest level, my equities are made up of 85% global and 15% emerging markets.

This is then diversified like:

- 25% Domestic

- 50% Developed World

- 15% Emerging Markets

- 10% Global Commercial Real Estate

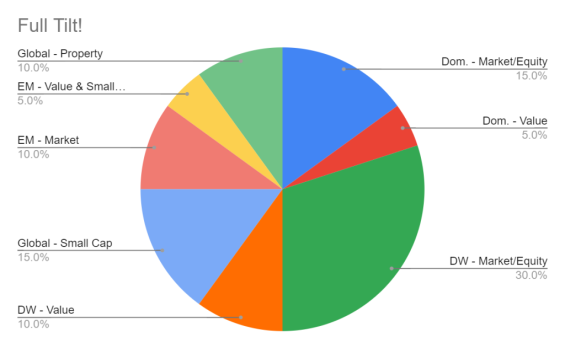

Finally, we can take a look at the tilted version of my portfolio. The percentages might look a little odd with the decimal place but I haven’t figured out how to sort that yet, the table values look fine but must have some formatting applied. Anyhow…

And with bonds included in the mix.

The actual current holdings in my portfolio are shown below, you’ll notice that there are a few areas that I am yet to invest in. I need to do more research in these areas and identify suitable trackers/ETFs.

| Domestic | Market/Equity | Vanguard FTSE 100 ETF (Dist) | VUKE |

| SPDR S&P UK Dividend | UKDV | ||

| Value | Vanguard FTSE 250 | VMID | |

| Small Cap | ?? | ||

| Developed World | Market/Equity | Vanguard FTSE All-World ETF (Dist) | VWRL |

| Value | ?? | ||

| Small Cap | ?? | ||

| Global | Small Cap | Blackrock Global Smaller Companies | BRSC |

| Emerging Markets | Market | Vanguard Emerging Markets ETF | VFEM |

| iShares Core MSCI Emerging Markets ETF (Acc) | EMIM | ||

| Value & Small Cap | ?? | ||

| Global Commercial Real Estate | Property | iShares Developed Markets Property Yield (Dist) | IWDP |

| Bonds | Short-dated, high quality bonds | Vanguard UK Gilt ETF (Dist) | VGOV |

| Short-dated, high quality, inflation-linked bonds | iShares Indexed UK Gilts | INXG |

It would be good to hear how your portfolio compares to mine by way of split and how you decided on the allocation of equities and bonds.