May was a mixed bag of ups and downs for me…

I started the month with a reoccurrence of depression which overlapped the May Day weekend and resulted in a week off work. This was followed by some positivity when I moved my tech blog, Knight Talks Tech, from Hostgator to Google Cloud Platform (GCP).

After seeing a note about using GCP from Saving Ninja in a Slack channel I’m part of I thought it was well worth a look. Ninja had said how he had set up WordPress in GCP having followed a video by a guy on YouTube, I watched the video and completed some of the steps. Things got in the way and I became distracted from completing the work.

I came back to this though having received an email from HostGator saying that my renewal was coming up and asking for a load of money from me. I wasn’t prepared to pay a couple of hundred pounds so that was incentive enough for me.

There were a few moments when I needed to do some supplementary Googling as things have moved on since the video had been created, but other than that, it all went well. In fact, having got to the end of the video, links for a revised instructional were then being promoted! 😀

Bit of a frugal move as it costs me £10/year for the .com domain and around 90 pence/month for hosting, definitely better than around £200 from HostGator.

Additional Income Streams

- Matched Betting £28 (Apr £16)

- Surveys/studies £0.24 (Apr £2.98)

- Amazon FBA/eBay £487 (Apr £0)

- TopCashBack £30.96 (Apr £0)

I made a fair bit via eBay this month selling off a few unwanted things like my son’s old moped (£349) and a couple of MyZone fitness belts (£100) which I no longer needed as I have the latest version. Selling the moped made a big difference financially as well as mentally, having it gone feels like a weight has been lifted.

The money from the moped went toward fitting a new carpet up the stairs and on the landing. The other eBay proceeds, TopCashBack money and vouchers I get for being part of a COVID-19 survey I used toward a 2020 iPad Air from John Lewis.

My profits remain on the low side for matched betting although I am hoping that will pick up next month when the Euros come round.

I use a service called Odds Monkey to help with my matched betting, I’ve been using them for several months now and find the tools they provide to be essential in making a profit. If you are interested then drop me a message or you can sign-up via my affiliate link – OddsMonkey. The great thing is you can do as much or as little as you like and it fits around your life.

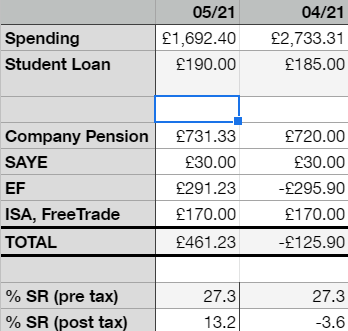

How did I do in May?

Assets

- Emergency Fund £2,441.91 (Apr £2,150.68)

- ISA, Freetrade £3,155.58 (Apr £3,128.50)

- ISA, Hargreaves Lansdown £2,985.23 (Apr £2,942.21)

- Pensions £112,741.54 (Apr £111,546.97)

- SAYE £570.00 (Apr £540.00)

- House £375,000 (£360,099) *Nationwide HPI 2020 Q4

The emergency fund has recovered a bit this month, just glad we have that in place and that it is available for us to use.

Liabilities

- Student Loan -£2,803.43 (Apr -£2,980.30)

- Mortgage -£188,430.57 (Apr -£189,389.70)

Total Assets (excluding house) – Total Liabilities = Net Worth

£121,894.26 – £191,234 = -£69,339.74 (Apr -£72,061.72)

The month-on-month figures look better compared to April with increases and decreases in the right places.

My Student Loan repayment is up by £5/month and my company pension contribution up by £11.33/month due to a pay rise effect from May.

Big turn around on the EF which is nice 🙂

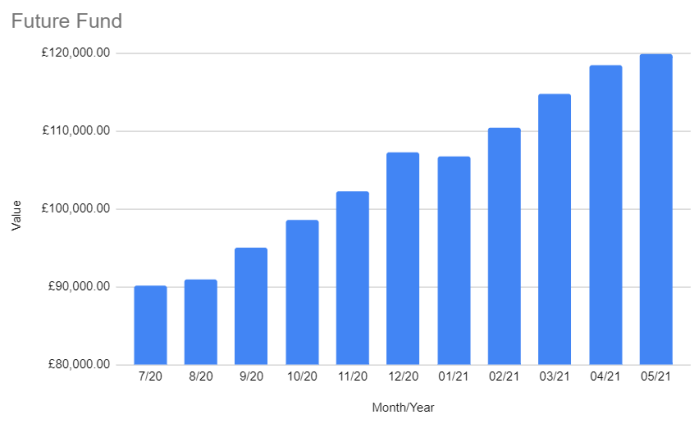

Future Fund

Just a shade under the £120k mark now.

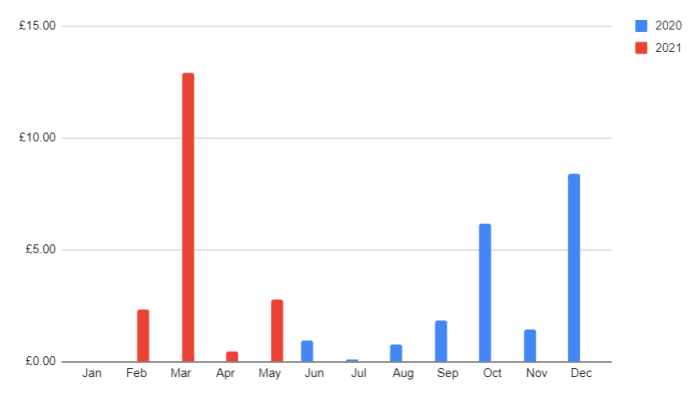

Dividends

£2.78 for May, I’m looking forward to seeing how June compares year-on-year

Here’s a little look at the composition of my lazy portfolio…

I’ve got a bit of cash sitting in the ISA waiting for me to invest, things have been so busy at home I’ve not got round to it yet.

Guest Post

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!

Vanity Metrics

These are metrics which serve me no purpose other than to see progress, or lack of, in the social media universe.

Alexa ranking: #6880720 (Apr #6880720 )

Twitter followers: 524 (Apr 507)

Blog followers: 57 (Apr 52)