I’m super-late publishing my February update and as a consequence, I can’t remember much to talk about for the month so I’ll crack straight on with things…

Additional Income Streams

- Matched Betting £232 (Feb £30)

- Surveys/studies £0 (Feb £5.82)

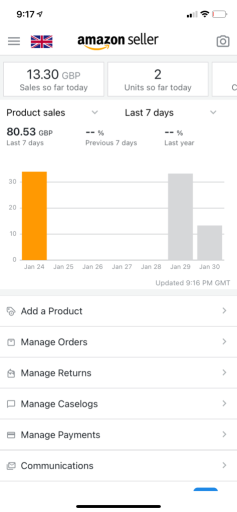

- Amazon FBA £30 (Feb £37)

- TopCashBack £0 (Feb £8.81)

The matched betting profit was exceptional compared to recent months, I made more bets and also took advantage of bet clubs and other offers. I think over the winter months I didn’t feel much like spending time in the evenings looking at bets and opted more for Netflix.

I use a service called Odds Monkey to help with my matched betting, I’ve been using them for several months now and find the tools they provide to be essential in making a profit. If you are interested then drop me a message or you can sign-up via my affiliate link – OddsMonkey. The great thing is you can do as much or as little as you like and it fits around your life.

FBA profits for February were made from the final sales of the items I sent in January. There was more competition in February which meant I needed to drop the sale price to shift my items, despite this I still was able to make a reasonable profit.

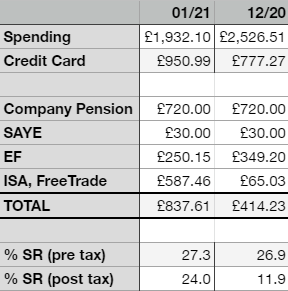

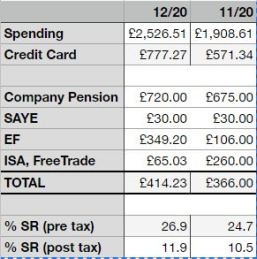

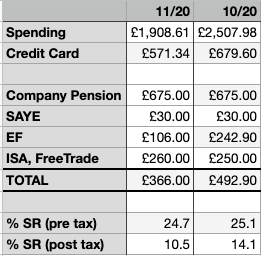

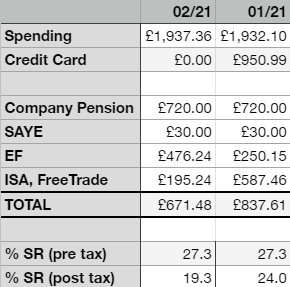

How did I do in Febraury?

Assets

- Emergency Fund £2,226.39 (Jan £1750.00)

- ISA, Freetrade £2,924.52 (Jan £2899.28)

- ISA, Hargreaves Lansdown £2,783.11 (Jan £2,849.54)

- Pensions £103,498.91 (Jan £100,040.25)

- SAYE £480.00 (Jan £420.00)

- House £360,099 (£350,883) *Nationwide HPI 2020 Q4

Liabilities

- Student Loan -£3,376.77 (Jan -£3,516.77)

- Mortgage -£190,464.67 (Jan -£190,422.22)

Total Assets (excluding house) – Total Liabilities = Net Worth

£111,912.93 – £193,841.44 = -£81,928.51 (Jan-£ 85,979.92)

I reached a milestone this month, my Emergency Fund passed the £2,000 mark, next up is to achieve enough money to cover one month of expenses.

The Emergency Fund is now made of NS&I Premium Bonds, fund investment and cash.

There is a fair bit of discussion around what one should do with their EF cash. For me, the main attributes of my EF are that the money needs to be accessible within a few working days and that it needs to be set to work. The fund part of my EF is the “riskiest” but I am comfortable having it there earning dividends and potentially growing in value too.

This month’s pension figure includes Mrs Frugalist’s Nest pension for the first month which makes the pension gain look a bit nicer 😉

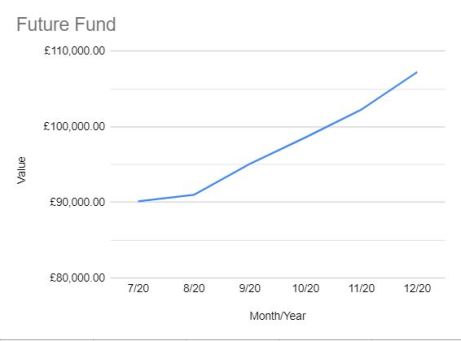

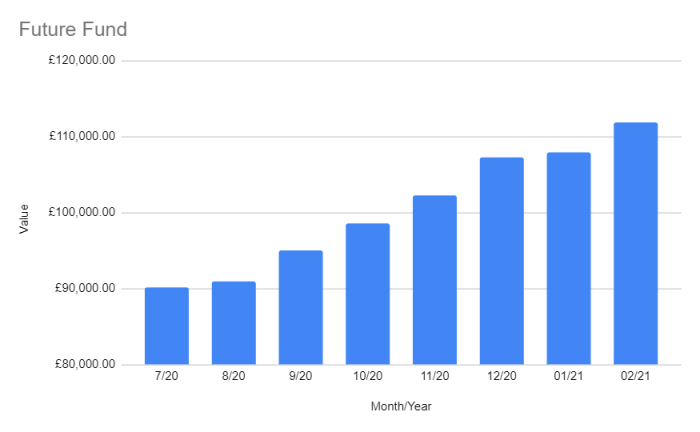

Future Fund

The main increaset this month is from the introduction of the Nest pension rather than any decent growth in the main pension.

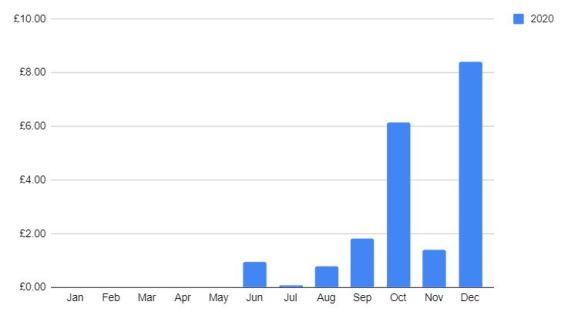

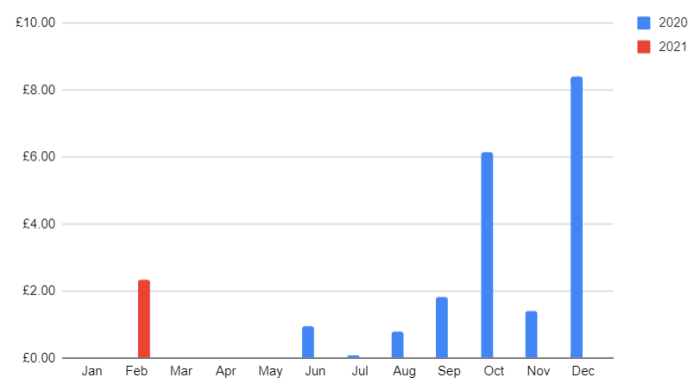

Dividends

Above average dividends for this month, I’ll need to revisit the investment details so I can forecast when to expect further payments.

Guest Post

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!

Vanity Metrics

These are metrics which serve me no purpose other than to see progress, or lack of, in the social media universe.

I have reappeared on Modest Money so I am able to compare stats again, hopefully on a consistant basis.

Alexa ranking: #6,700,360 (Jan # 4,267,238 )

Twitter followers: 437 (Jan 382)

Blog followers: 46 (Jan 44)