Not happy with another car bill on the horizon, I decided the best thing for it was to sell the car. I did the usual of checking out the dealer buy-back price, We Buy Any Car, and the local garage but none of them could come close to motorway.co.uk

I took a load of photos of the car, chatted with them about the condition and they sent the details out to all their buyers. The next day I had a really good offer come in that was £2.5k higher than expected. So, the next week the Polestar was loaded onto a transporter and made its way up to Edinburgh.

Bit disappointed with the V60 Polestar in terms of reliability, my previous V60 I had for a couple of years longer and it just needed new tyres.

It was a beast of a car and so much fun to drive but by selling that I could buy a Toyota Auris hybrid which saved me £585 car tax each year, around £100/year insurance, and sooo much on petrol. Plus it left me with a fair-sized pot of money 🙂

With the extra cash sitting in the bank I decided to pay off my student loan so I called them up, got my redemption figure and paid straight away. Such a good feeling to know that another debt has been cleared. I know people have mixed feelings on paying off their student loan and some see it more as a “tax”.

Interesting thing is, after a few days the online balance for my loan showed the debt had been cleared and also that there was a small credit on the account – not sure how that would be given that we worked off a redemption figure. Oh well!

Of actually annoyance though was that my employer still took a student loan repayment from my pay this month and that hasn’t shown up on my loan account. I guess the notice from SLC & HMRC hadn’t been received in time. Not the end of the world as I expect to get that repaid some point in September.

Talking about repayments, I should be getting my car tax refund through next month too which should be around the £450 mark. I’m in two minds as to whether invest it or tuck it away in a new savings pot potentialy to pay for my Masters degree.

The frugle side of me takes over this time of year when both my car and home insurance come up for renewal. This kick-starts a flurry of comparision site searches for the best deal which I then check against TopCashBack for any further goodness.

This year I have saved £30 off my car insurance and got roadside recovery included plus £40 cashback from using the TopCashBack service.

At the time of writing I have still to finalise my home insurance but my renewal offer is the same as last year so at least I know I’ll not be paying more if I decide to stay with them.

Additional Income Streams

- Matched Betting £29 (July £9.16)

- Surveys/studies £0.93 (July £0)

- Amazon FBA/eBay/FB Marketplace £50 (July £13.79)

- TopCashBack £0.14 (July £2.37)

Continued to clear out items via eBay and Facebook Marketplace, mainly due to pressure from my wife! 😀

I know some of the items I’ve sold could have been priced higher but to be fair, I just wanted the items gone. At the end of the month, anything that was being advertised and hadn’t generated any interest was taken to the local Nansa charity shop.

The income from matched betting is starting to be a more consistent flow as I’m making more effort to take adavantage of bet clubs and offers around the football World Cup and a few other major sporting events. Still a long way off what I was making in my early matched betting days but something is better than nothing.

I use a service called Odds Monkey to help with my matched betting, I’ve been using them for several months now and find the tools they provide to be essential in making a profit. If you are interested then drop me a message or you can sign-up via my affiliate link – OddsMonkey. The great thing is you can do as much or as little as you like and it fits around your life.

How did I do in August?

Assets

- Emergency Fund £3,192.51 (July £2,928.621)

- ISA, Freetrade £4,240.64 (July £3,228.42)

- ISA, Hargreaves Lansdown £3,435.97 (July £3,249.52)

- Pensions £120,869.69 (July £117,335.14)

- SAYE £660.00 (July £630.00)

- House £375,000 (£360,099) *Nationwide HPI 2020 Q4

Liabilities

- Student Loan +£13 (July -£2,503.82)

- Mortgage -£185641.19 (July -£187,074.21)

Total Assets (excluding house) – Total Liabilities = Net Worth

£132,398.81 – £185,628.19 = -£53,229.38 (July -£62,236.33)

Very satisfying to have that final payment listed in the spreadsheet this month. It will feel strange not reporting on any debts next month!

Slightly up on the EF payments – these are a combination of round-ups on certain transactions plus regular payments.

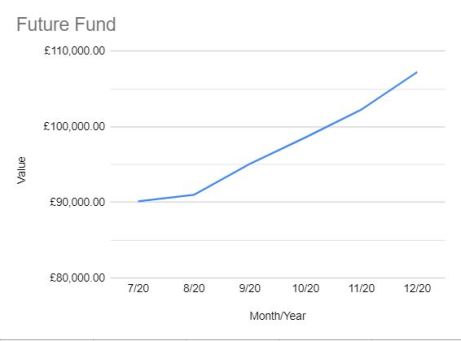

Future Fund

My next milestone is £150,000 for my Future Fund. It’s great to see this number increasing and my negative networth (excluding house) inching toward a positive figure.

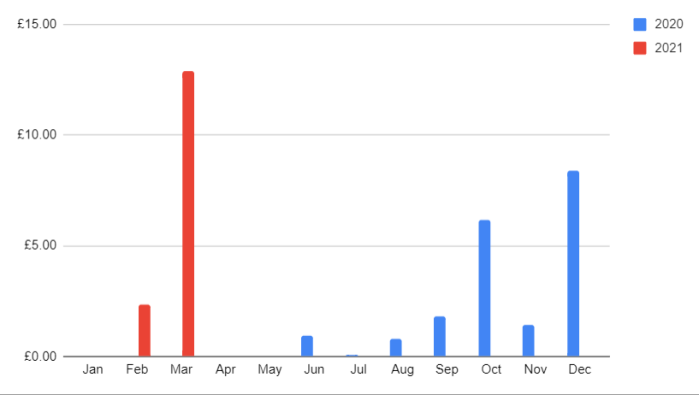

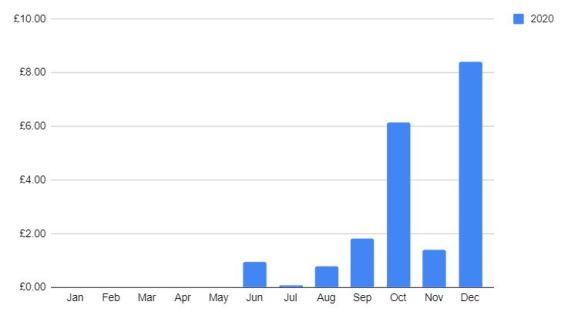

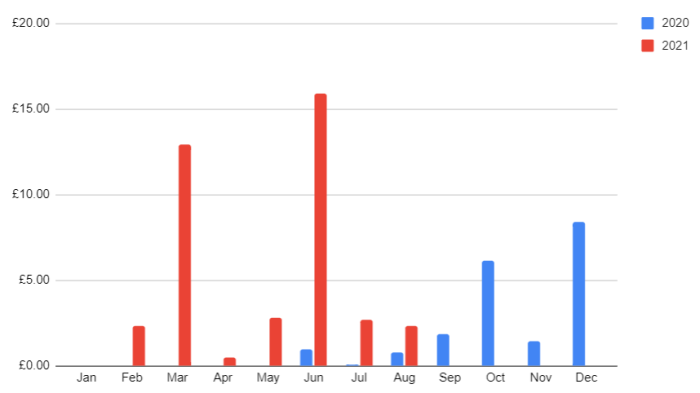

Dividends

Just under £40 for this year and with four months to go, it’s looking good for my target. My average monthly dividends are £4.92 which is nearly enough to cover one of our mobile phone bills 😀

Goals

Read more – not so much reading this month, the same with audiobooks which I normally listen to when walking Skyla – I’ve just been enjoying the sounds of nature which I find very calming.

Exercise more – August was a real struggle for exercising as I’d managed to get golfers elbow, also known as tendinitis, from weight lifting. This really set me back mentally and as a result, I didn’t attend many classes at all. I did finish the month strongly though with a Body Attack class and two treadmill sessions in the final weekend. This got me just enough MEPs to meet the minimum monthly target.

Learn more – I spent quite a bit of time working through an ethical hacking course which I found really interesting, so far I have been able to use a Kali Linux VM, USB wireless adapter, and a few packages to run deauth attacks. I’ve only done this on my wireless network for obvious reasons (I don’t want to end up in jail!) but it was cool to be able to prevent one of my Echo Dots from connecting to the Internet 🙂

I have also been spending some time looking into a framework called Flutter, which is used to develop good looking, cross-platform mobile apps.

Earn more – Effectively by paying off my student loan I will be bringing home a bit more money each month which could count as extra earnings – a pound saved is a pound earned, right? 🙂

Guest Post

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!