It was a tough month at work, sometimes despite having loads to do I can find it hard to keep going. The work is typically varied and normally it keeps me interested but perhaps it was the change in weather or completing a challenging task that left me feeling a bit down, I’m not sure. This then rolled into me developing a sore throat and then a list of other symptoms which scarily sounded a lot like COVID-19.

I decided to take sick leave and self-isolate but as things didn’t improve I booked myself a test, I make it sound easier than it actually was – it turned out to be pretty hard to book any kind of test! Despite having a drive-in testing centre about a mile from my house I had to wait three days before I was finally lucky enough to get offered a home testing kit.

After getting the test kit ordered, the rest of the process was pretty decent. The kit arrived the next day, I then got it returned the same afternoon and within two days I got the result back which was thankfully negative. The odd thing though with the fam self-isolating is that my daughter was actually put out about having to stay off school! 😀

One downside to being ill was that it interrupted my gym routine and I don’t mean that in a vain way, it is one of a few things that keeps me well balanced and in a reasonable state of wellbeing. Thankfully after a week and a bit off while the symptoms cleared, I was able to go back and restart the classes.

I managed to spend a fair bit of time this month reading and listening to audiobooks, not all personal finance-related, I enjoyed listening to The Amityville Horror although I had to replay a lot as I kept dozing off during it! It’s a good book though and I’d recommend borrowing a copy from the library.

Also, I took some produce from the garden…

Not a huge amount, the potato plants are still growing as are the pears so will provide more in the months to come. The pears are actually pretty large, the photo doesn’t really do them justice, in fact they are large enough that they have caused the tree to lean over so I should really start picking some more!

At the same time as the potatoes, I also planted some onions but they grow much slower so won’t really be ready until maybe Decemeber. I have taken a couple up though and used the to add to a salad as I planted a mixture of red and white. The carrots didn’t survive due to Skyla digging them up before they could get established.

The apple tree was reasonably fruitfull this year and have contributed to a good few apple crumbles. We also have a dwarf pear tree in the front garden which typically is pretty decent but nothing this year.

All good stuff though, food on the table and some fresh air & fun prepping, planting and picking 🙂

Additional Income Streams

- Matched Betting £158 profit (Aug £168)

- Surveys/studies £17.99 (Aug £19.27)

I didn’t take out any profit from my matched betting but the survey profit I used to reduce my credit card balance.

While off ill, I was looking at ways to bring in extra income and I came across JustPark. This company (I’m sure there are others too) allow you to rent out any car parking space (or garage) that you don’t need and also help you find parking if you are visiting somewhere. If you sign-up via my referral link* and rent out your space then we both get £10 to spend on parking, or a £10 Amazon card.

No takers yet but it is not surprising with the lockdowns and large numbers of people working from home. In the future I may get a bit of business if the larger Aviva offices reopen and people start coming back but we’ll see, I’m not losing anything by making it available.

Matched Betting

Completed all the easy new account offers via Odds Monkey so I’m now starting with the average difficulty ones. The fact that all the easy ones are done has had an effect on my monthly profit, that and making a few mistakes. I’m still learning so I expect to mess a few bets up so I’m not too cut up about that.

I’ve been chatting with Weenie about accumulators so that is something I’ll be trying out in October, not sure what the results will look like but hopefully gain more profit than I lose.

Also opted to switch to annual renewal for my OddsMonkey membership, this was a pretty decent result as 12 months was being offered at £140 (£10 saving) compared to £15/month.

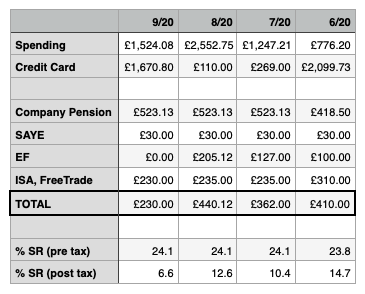

How did I do in September?

Spending was down significantly compared to last month as there were no large expenses to sort out.

I didn’t add any further contributions to my Emergency Fund as I put that, together with savings from spending, and paid down a decent wedge on my credit card balance.

It’s such a good feeling seeing the credit card balance edging nearer to zero. Once I’ve got this paid off I’ll have to decide whether to start paying off my student loan or the smallest part of my mortgage (it’s made of up four parts; two at a lowish rate and two at a higher rate).

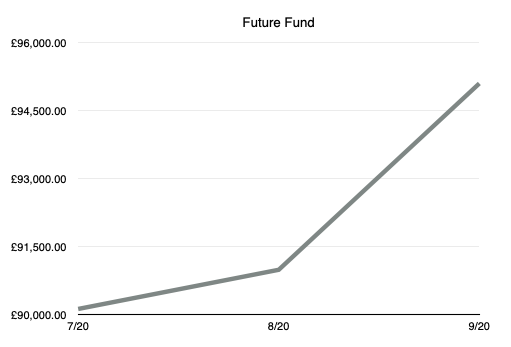

Future Fund

Contributions to my Future Fund via Pension, EF, and ISA didn’t change much with the exception of the EF payment as mentioned previously.

The sharp rise during September is down to the inclusion of an ISA and also an uplift of just over £2700 in my pension.

It will be cool to pass the £100k mark although that could take a little while yet but seeing this graph and my decreasing debts are giving me a ton of motivation to keep pushing ahead.

* This is an affiliate/sign-up link, please see my Affiliate Disclaimer.