Dreaming of lazy days relaxing with a nice cup of tea or coffee pondering what useful contribution you will make that day?

Well, you may have to put that thought on hold, at least for another couple of years, thanks to the government.

From 2028, the minimum age at which those with a private pension can access their funds will rise by two years from 55 to 57. This was originally announced back in 2014 but the legislation was not amended to include provision for implementing the change.

On the 28th August, Labour MP Stephen Timms tabled the question asking the Chancellor of the Exchequer what plans he has to increase the minimum age at which people can access their private pensions.

John Glen (pictured right), Secretary to the Treasury, responded with the following statement on the 3rd September.

“In 2014 the government announced it would increase the minimum pension age to 57 from 2028, reflecting trends in longevity and encouraging individuals to remain in work, while also helping to ensure pension savings provide for later life.”[1]

This change will affect those in their mid-forties or younger with any future plans of retiring early at 55 or drawing down to supplement their salary will have to wait a further two years. This may not sound terrible, but it does demonstrate that the government are willing to poke their finger into the personal finance pie.

There is no saying whether the government will return to private pensions in the future making additional changes to the age at which we can access our pension.

In my opinion, if I choose to invest money in a private finance vehicle then it should be up to me when I access it, in accordance with the investment criteria that is. Private pensions and investments should provide individuals with options on how they spend their years whether that be working or pursuing other interests.

Mr Glen suggests that the change will encourage “individuals to remain in work” – well, what if individuals do not want to remain in work? If we have worked hard and invested wisely, it should be our decision to make. Some may be happy to stay in work and that’s fine, nothing wrong with that at all, but others there may be something else they want to try out to increase their happiness and wellbeing.

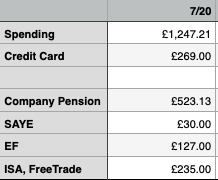

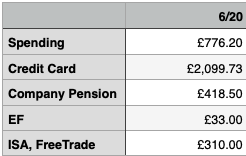

Despite my feelings on this I will continue to contribute to my private pension, I still feel like it is the right thing for me to do at this time, plus it would be silly of me to not take advantage of my company matched contribution too.

I will, however, be reviewing my numbers and adjusting accordingly to accommodate this change. I expect it will mean that I will need to depend on a higher level of income from my ISAs for those two years if I am at the point of Financial Independence by the time I reach 55.

How do you feel about this change?

Will it affect your plans for financial independence or early retirement, and how will you mitigate the change?

References

1. Glen, J. (03/09/2020). Pensions – Question for Treasury. Retrieved from https://questions-statements.parliament.uk/written-questions/detail/2020-08-28/81494 on 13/09/2020.