It’s been such a while since I put together an update on my finances – there’s a lot that has happened in the past 18 months or so!!

My finances took a bit of a battering with legal fees having to be paid for a divorce, house sale, and house purchase. Plus I had to take a pretty big pay cut due to a round of redundancies at my company. But, I have my new home which I am over the moon about and a job so it’s not all bad!

Additional Income Streams

- Matched Betting £0

- Surveys/studies £0

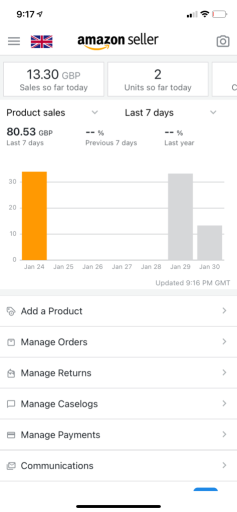

- Amazon FBA/eBay/FB Marketplace £0

- Cashback £0

I’ve got several boxes of things to sell on FB Marketplace and ebay since moving house, I need to make the time to get started. I know from previous experience that once I start it’s not too bad, just that it is not an exciting prospect of going through boxes piled up in the garage 😀

Cashback services I use are TopCashBack and QuidCo, I tend to keep an eye out for any easy offers they have e.g. sign-up for a credit checkign service and earn £2.50. Usually I would just do a quick check before buying something to see who offers the highest cashback then go via that site/app.

How did I do in February?

I do realise that crypto is not investing, it’s speculating, which is why I only bought a small amount of BitCoin and Ethereum (now Ethereum 2) a long while back. I have several other currencies but they are only small amounts earned from completing tests etc.

Assets

- Emergency Fund £7,840.00 (Jan £7815.00)

- ISA, Freetrade £3,905.23 (Jan £3,713.96)

- ISA, Hargreaves Lansdown (£3,435.97)

- Pensions £150,311.52 (Jan £146,734.81)

- Crypto £582.33 (Jan £399.49)

- House £105,113.50 (Q2 £106,875.00) *Nationwide HPI 2023 Q4

Liabilities

- Mortgage -£79,448.09 (Jan -£79,624.21)

Total Assets (excluding house) – Total Liabilities = Net Worth

£162,639.08 – £79,448.09 = £83,190.99 (Jan £82,475.02)

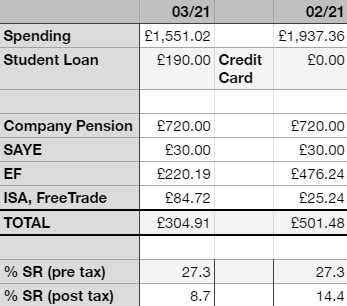

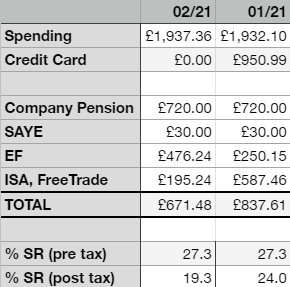

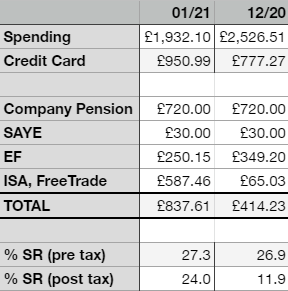

The comparison in monthly figures isn’t great this month, march should be more aligned though.

Still, I’m glad that I have no debt, other than mortgage, that I’m carrying. I have struggled with using credit cards in the past so after I moved house I made sure that I remvoed my Amex from Amazon, Apple Wallet etc. to avoid falling into the same trap.

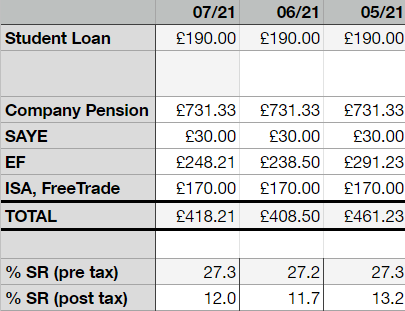

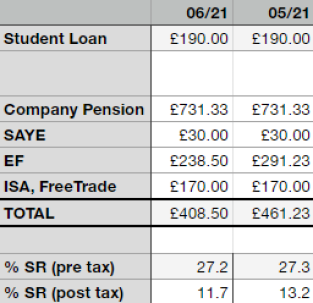

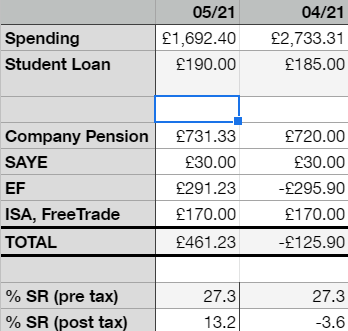

The savings rate this month compared to January 2023 is interesting as the numbers are heavily affected from my cut in salary. I feel like I want to step up my investing contributions again but have been waiting for the bills to settle down since moving home.

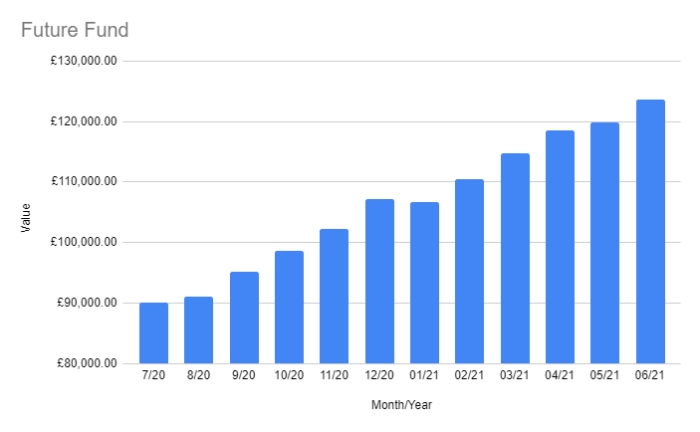

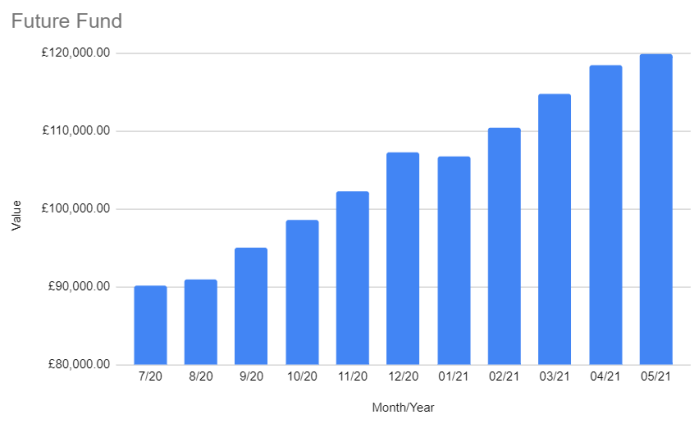

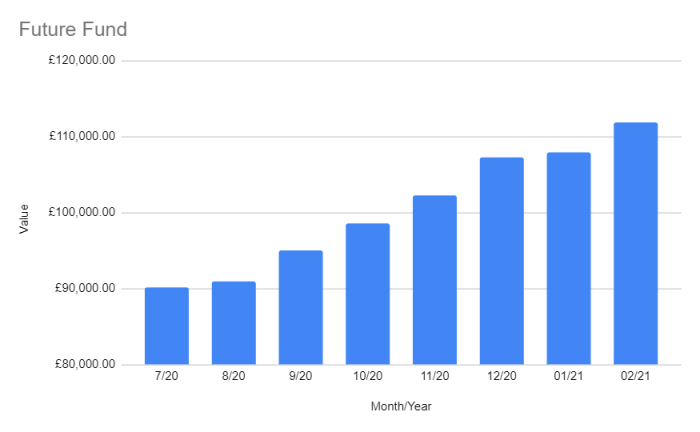

Future Fund

My milestone of £15,000 for my Future Fund is small for most FIRE people but it feels like a way off just now 🙁

My Future Fund value is slowly creeping up and I now have a positive networth (excluding the house) in most part due to a much smaller mortgage.

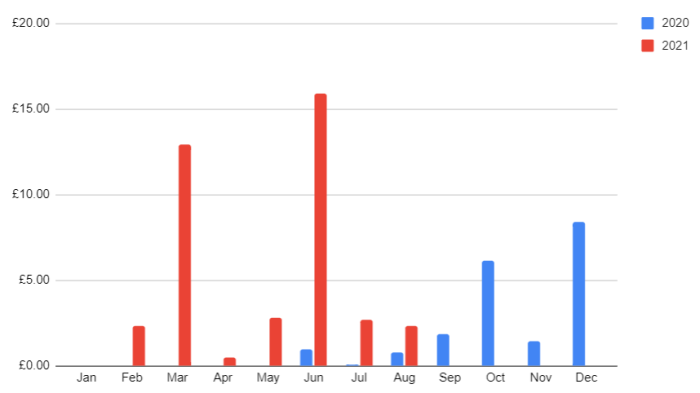

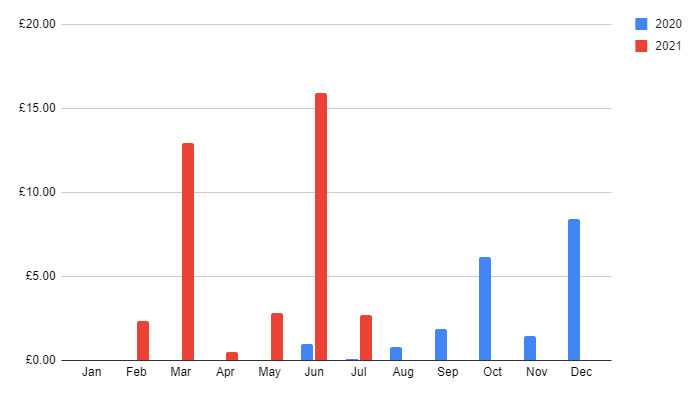

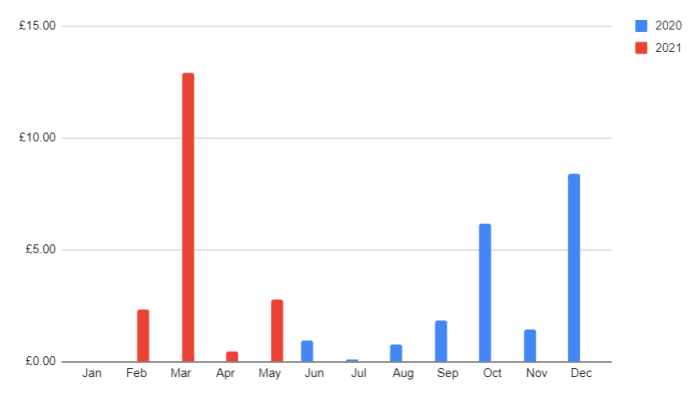

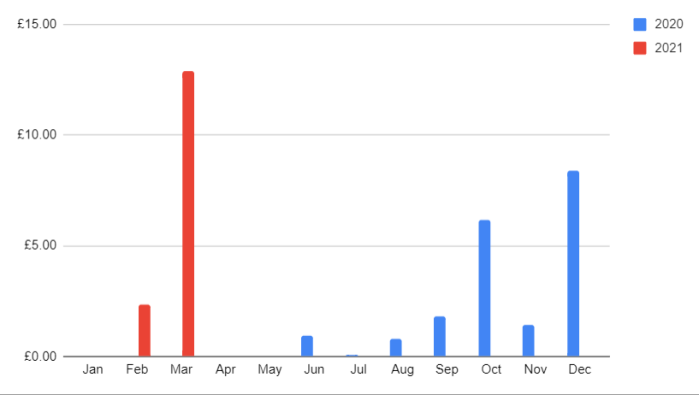

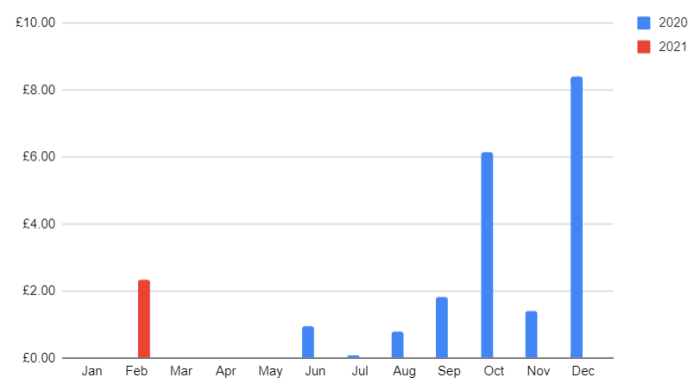

Dividends

Last year, I received £163.34 and for 2024 I am currently at £52.28, averaging £26.14/month (2023 £13.61/month). Not enough to retire on but would cover some bills. All my dividends are being reinvested.

Goals

Read more – Last year I read 20 books, mostly fiction but a few personal finance and self-development books. This year, so far, I have managed to read six, again mostly fiction. I enjoying the fiction as it’s a nice change from my day job which is very technical.

Exercise more – This seems to be an every present goal!! I have assembled a fair home gym set up in my garage which consists of a power rack, pull down machine, a couple of punch bags, a turbo trainer and several bars and free weights.

The majority of my exercise though is walking Skyla which I’m looking forward to more now that Spring is here and we have more post-work day light 🙂

Learn more – I passed my Microsoft Azure Administrators exam a couple of months ago which has motivated me to push on with my work-related training. I am now studying toward a VMware exam which I hope to take either in April or May.

My Masters in Strategic IT Management resumes in April so I will have to be careful about balacning my time as that requires twenty hours ish of study time each weel 🙁

Earn more – This feels more important than ever at the moment having taken a pay cut and also being solely resposnible for the bills! I’ll be looking to resume paid surveys as I remember them not requiring a lot of time or effort. Undecided about Matched Betting, it’s been a long while since I did that so i think it will be like learning from scratch again.

Guest Post

If you are interested in writing a guest post for my blog, you can reach out to me via the contact page or by taking a look at the let’s work together page – it would be great to hear from you!