This article contains affiliate/sign-up links.

Some good news on the work front this month, my team were told we would be returning to 100% hours from July – yay!

The entire workforce was put onto 80% time/salary at the start of May as a precautionary step to protect the financial wellbeing of the company. I was initially worried about the financial impact this reduction in hours would bring but we have coped fine thankfully, my wife picked up extra shifts so it lessened the blow a bit.

How did I perform financially? I’ve put together a few figures to try and establish some benchmarks for future months, there may be a bit more detail for some areas than others at the moment but I’m working on that.

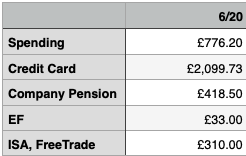

Spending

This covers our expenses such as groceries, travel costs, pets, and any other discretionary spending for the month. Not sure how this would compare to other families of four but it is the lowest for amoutn spent in a month this year – not sure if that’s because we have been doing less or if I’ve messed up the tracking somewhere!

Travel costs are really low at the moment as my wife is cycling to work, I’m still working from home, and we have declared our car off road with the DVLA.

I anticipate a much improved accuracy for spending in July as I have taken up the use of an app called “Emma” which utilises the open banking here in the UK to amalgamate transactions and balances across mutliple accounts. More on this app in another post, but it you’d like to take a look and sign-up in the mean time, please use my link* as I earn in-app points 🙂

Credit Card

I was a little hesitant in adding this category as I feel a degree of shame about getting into credit card debt. In fact, I have carried around this type of debt since my twenties, occasionally paying off the balance in full only to build it back up again. But, as Vicki Robin says, “No shame, no blame”!

Decided to use some extra money we had to pay down the debt a bit more aggressively this month than we usually would. Feels good to see that number come down and also get the balance below 25% of my credit limit.

Having been listening to the ChooseFI podcast for a little while now, the idea of using travel reward credit cards has grown on me but I still harbour a “fear” of the cards and the trouble they can cause without sufficient will power.

Company Pension

I use salary sacrifice to make the most of my income, this reduces the amount of income tax I have to pay as my salary is effectively reduced. My company offer a 3% contribution match which I take advantage of plus I add a decent percentage on top of that.

The scheme is run by Scottish Widows and typically does okay but the 2019/2020 year ended in a negative performance percentage. This resulted in my pension pot losing a few hundred pounds despite the contributions.

Emergency Fund

Contributions to my EF were low this month, mainly because I forgot to add the money 🙁

Note to self: automate this to avoid the same happening again!

Pretty much all the podcasts and books talk about setting up an EF to cover three to six months of expenses, this feels pretty daunting when starting out. My first target is to cover one month’s worth, then I’ll aim for two months. I feel much more inclined to keep going when the goals are achievable, they don’t have to be easier but achievable none the less.

ISA, Freetrade

I opened my Freetrade ISA in May and added a further £310 to it during June. The cash balance was invested in funds according to my portfolio strategy which I’ll talk about in another post. I don’t have a magic link for Freetrade but if you are interested in opening an account (in the UK) then message me and I’ll send one through, we’ll both then earn a free share worth between £3 and £200 – nice!

That pretty much rounds out my thoughts on my June finances, a bit late in getting these written down and published but heh-ho 😀 Next month, I intend to get round to this a bit earlier and making small incrementally improvements to my systems should enable this.

Quick question for you, do you use reward credit cards? If so, what have they enabled you to do, what places have you visited courtesy of using these cards rather than using a debit card?

Thanks for making it this far! Let me know what your thoughts are on financial updates and the kinds of things you measure.

Have a great week 🙂

* affilitate or sign-up link

I totally get your hesitancy on the credit cards – for pretty much most of my 20s and all of my 30s, I had big credit card debts. At first, I thought this was normal but when I realised it wasn’t, then came the hard task of paying it all off (which I eventually did). Nobody knew (friends or family) as I was ashamed I’d been so silly with my money.

My credit cards in the past got me Airmiles which paid for a couple of return flights to the far east but if I think about it, what I saved probably was less than what I paid in credit card interest 🙁

I see people doing well ‘stoozing’ credit cards, but given my past relationship with them, it’s not something I want to try out.

These days, my paid off M&S credit card gives me vouchers which I use to treat myself and that’s enough!

Hey weenie,

It’s strange how credit card, and other consumer debt, are considered “normal” now. Certainly, in my parents time, they would not have spent money they didn’t have and each big purchase had to be budgeted for.

I know what you mean with the interest cost outstripping the free flights, I used to have a British Airways Amex card and although we got several free flights (all European though!), the interest paid would have exceeded the actual flight cost 🙁

As I’m paying down my Virgin Money card and have no intention of using again, I have cut the card up and also used the mobile app to freeze the card in case it is stored with any online retailers that I may use.

Will be so glad to get out from under this debt, I’m sure I’ll feel a few inches taller without having to carry around the weight of debt! 😀

That’s good you have a healthy relationship with your M&S card, I think when I have this card sorted I may see if there are any prepaid reward cards so I can only spend what money I have.

All the best with payiing off your Virgin Money card – that was one of the cards I eventually paid off!

I too cut up my cards after they were paid off but kept one as back up. There’s still quite a large credit limit on there which could be used if something really dire happened and I needed credit quick.

Thanks! Bet it felt amazing to make that final payment eh?

The VM card is 0% until December next year I think so although there may be better FI options to paying it off but it’s where my mental wellbeing trumps having the debt hanging around.

I’ve heard of a trick to “lock away” the credit card by freezing it in a block of water – cuts back on impulse purchases but leaves it available if needed for those situations you mention.

I use a Tesco credit card so that I can earn clubcard vouchers. I have a direct debit set up to automatically pay it off in full. I put all my spending on the card, which makes it pretty easy to track what I’m spending. I did the whole spending lots of fun money on a credit card in my late twenties and early thirties. It took me a couple of years to pay them off, and I won’t ever borrow on a credit card again. I don’t have any issue with using them as a tool though to track what I’m spending and get something for nothing. I heard that trick about freezing the card too so you have it for emergencies, but you’re not tempted for impulse buys. Honestly though, knowing that you’ve worked hard to pay your debts off is incentive enough not to go there again.

Hey,

It’s funny as I’m in two minds right now about credit cards – I have the worry that I’ll not be able to stay in control but then also seeing people like yourself and weenie using them to your advantage makes me think it might be possible for me in the future.

Good point you make about knowing how much hard work it was to pay them off, I’d never want to get back into this position again so that should help me keep a grip on things!

Got a way to go yet though before I have to think about using a card for transactions 😀

Did you look around much to find the best card for you in terms of rewards? Did you consider the travel cards like B.A Amex or was it more the useful day-to-day rewards from Tesco that were more appealing?

I’ve had the Tesco card for a lot of years now. The rewards used to be much better, but I still get a decent number of clubcard vouchers purely for the credit card spending. At the time when I took it out my kids were much younger and I wasn’t doing any foreign travel. I used to exchange the vouchers for hotel stays for weekends away. It worked really well. I don’t think the deals are quite as good now, and I sometimes find myself just spending them on bits and bobs that I need in Tesco. With two teenage boys to feed Tesco vouchers are probably more useful for me than anything else!